About Course

Course Description

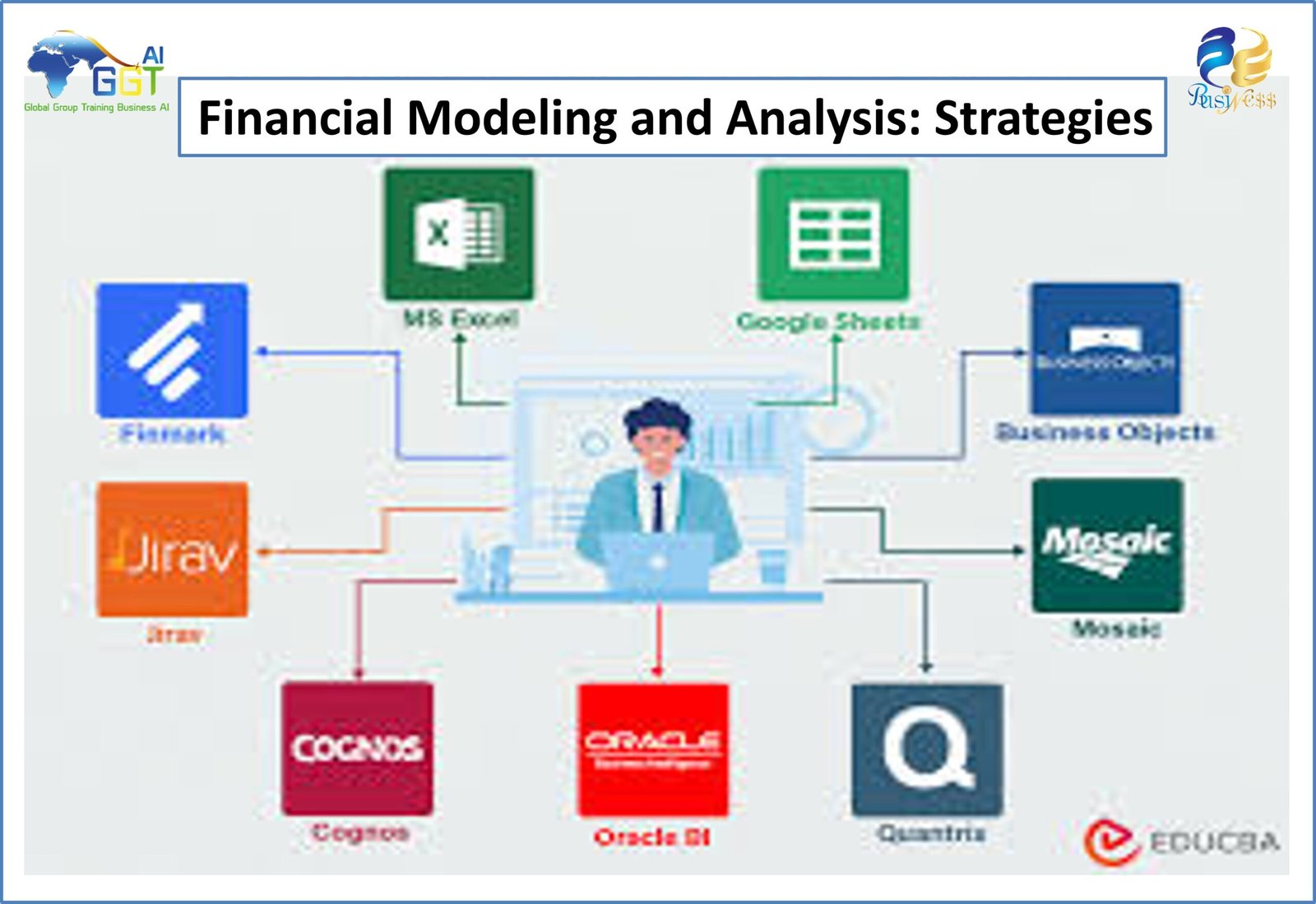

What is Financial Modeling?

Financial modeling involves the construction of a computer-based representation of a financial situation. This model, typically a spreadsheet, incorporates historical financial data, assumptions about future performance, and various calculations to project a company’s financial performance over a specified period. Financial models are used for a wide range of purposes, including:

- Evaluating investment opportunities: Financial models help assess the potential return on investment and risk associated with various investment options.

- Forecasting financial performance: Businesses use financial models to predict future revenue, expenses, and cash flow, enabling better decision-making and resource allocation.

- Mergers and acquisitions (M&A): Financial models play a critical role in valuing companies and determining the feasibility of M&A transactions.

- Risk management: Financial models are employed to identify, quantify, and mitigate potential financial risks.

Certification

Upon successful completion of this course and passing the final exam, you will receive a certificate of completion from GLOBEL GROUP to showcase your newfound skills.

Who This Course is for

This course is designed for individuals who are passionate about leveraging data to drive business success and are looking to advance their skills in Financial Modeling and Analysis Strategies. It is suitable for:

- Financial Modeling Analysts

- Business Professionals

- Aspiring Financial Modeling Scientists

- Entrepreneurs and Startups,

- Students and Researchers

Student Ratings & Reviews